Solana Price Prediction: Triangle Breakout and Institutional Demand Could Propel SOL to $257

#SOL

- Technical Rebound Signals: Oversold RSI + MACD crossover suggest near-term recovery potential

- Ecosystem Growth: Seeker Phone expansion and institutional SOL accumulation (2M+ coins) provide fundamental support

- Meme Coin Momentum: Trader interest in SOL-based assets like TROLL indicates retail FOMO remains active

SOL Price Prediction

SOL Technical Analysis: Key Indicators Point to Potential Upside

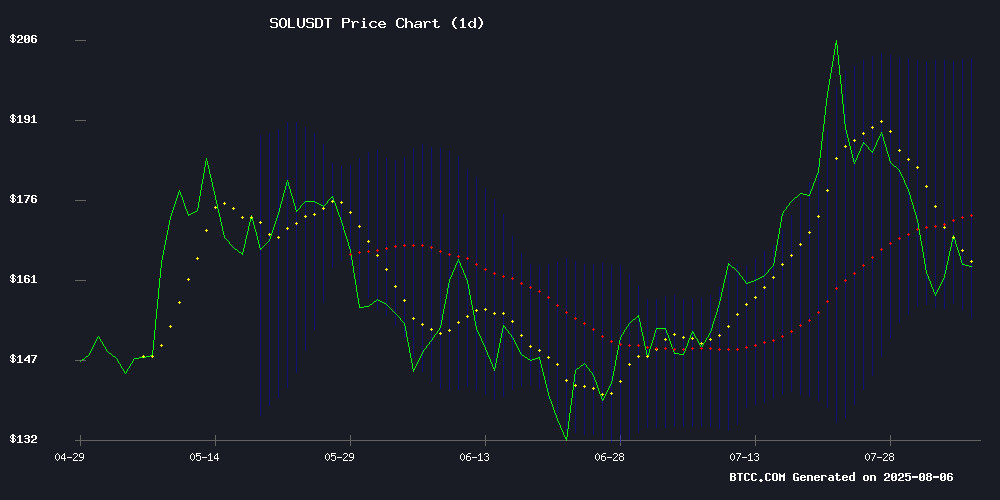

SOL is currently trading at $163.83, below its 20-day moving average of $178.24, suggesting a short-term bearish trend. However, the MACD shows a bullish crossover with the histogram at 11.4012, indicating growing momentum. Bollinger Bands reveal price NEAR the lower band ($154.19), which could signal an oversold condition. 'The technical setup suggests SOL may be poised for a rebound if it holds above $154,' says BTCC analyst William.

Market Sentiment Turns Bullish as Solana Ecosystem Expands

Positive developments like Binance's new wallet, Solana's Seeker Phone expansion, and institutional accumulation (Upexi Inc. now holds 2M SOL) are fueling optimism. 'The $300 price prediction aligns with growing ecosystem strength, though MACD divergence warrants caution,' notes William. Breakout patterns in PENGU and TROLL meme coins show retail interest remains strong.

Factors Influencing SOL's Price

Binance Launches Keyless Desktop Wallet for Seamless Crypto Trading

Binance has unveiled a groundbreaking desktop-native web wallet, designed to merge security with simplicity for both professional traders and mainstream crypto users. The Binance Wallet (Web) operates directly within browsers, offering full asset control on BNB Smart Chain and Solana networks.

Its standout Secure Auto Sign (SAS) feature eliminates repetitive transaction approvals, streamlining decentralized trading. The wallet's keyless architecture leverages a Trusted Execution Environment (TEE), ensuring private keys remain inaccessible even to Binance—bolstering security without sacrificing user sovereignty.

This release underscores Binance's push to democratize DeFi access while catering to desktop traders' performance demands. Browser integration removes friction, positioning the wallet as a bridge between institutional-grade tools and mass adoption.

Solana Price Prediction: Triangle Breakout and Whale Moves Signal SOL’s Push Toward $300

Solana is building momentum amid a stagnant market, with technical and on-chain indicators suggesting a potential surge toward $300. The network recently achieved a record 1,318 true transactions per second (TPS) in July, setting a new benchmark for Layer 1 performance. This sustained activity reflects growing adoption rather than short-term speculation.

Technically, Solana exhibits strength with higher lows and an ascending triangle pattern near key resistance. Nearly $52 million in liquidation pressure around $188 further underscores the potential for upward movement. While broader market conditions remain choppy, Solana's fundamentals are quietly positioning it for a breakout.

Pudgy Penguins (PENGU) Price Prediction: $10B Market Cap in Sight as Technical Patterns Align

Pudgy Penguins has surged in visibility, with daily views exploding from 100 million to 908 million in under 18 months. The Solana-based meme coin's organic growth mirrors bullish technical formations, suggesting a potential breakout.

Fibonacci retracement levels indicate consolidation near previous highs, a classic setup for continuation. Traders note the alignment between rising community engagement and price action, a rare convergence for assets in this category.

Switchboard Launches Surge, Solana’s Fastest Oracle Yet

Switchboard's new 'Surge' oracle network has gone live on Solana's mainnet, promising unprecedented speed and cost efficiency. The oracle delivers price feeds with sub-100ms latency—an 8x performance improvement over existing providers at roughly 1/100th the cost. Protocols colocating with Surge nodes can achieve even lower latency of 8-25ms, rivaling centralized exchange speeds.

Surge replaces conventional pull oracles with a direct WebSocket stream, bypassing consensus delays. Prices are pushed only when market movements exceed predefined thresholds, eliminating wasteful slot-by-slot polling. This architectural shift targets high-volume applications seeking CEX-grade latency on-chain.

Solana's Seeker Phone Expands Globally Amid Regulatory Shifts in South Korea

Solana Mobile has launched its second-generation blockchain smartphone, the Seeker, in over 50 countries. The device, which has already garnered 150,000 pre-orders, features hardware upgrades and on-chain tools tailored for Web3 users. Key innovations include a Seed Vault for secure private key storage and a decentralized app store.

Meanwhile, South Korea is advancing its digital economy agenda with updated cryptocurrency regulations. The move signals the country's ambition to become a leader in blockchain adoption. Artist Takashi Murakami's NFT card packs on Base network further highlight the region's creative Web3 momentum.

Trader Misses $36 Million Windfall on Solana Meme Coin TROLL

Leland King Fawcette, a Solana meme coin developer, revealed a costly misstep in his trading history. In August 2024, he purchased $1,300 worth of the TROLL token, only to sell it hours later when the price failed to rally. At the time of his sale, TROLL's market capitalization stood at a mere $9,360.

Nearly a year later, the token's valuation has surged to $158 million, turning what could have been a $36 million payday into a cautionary tale. Fawcette authenticated the transaction through on-chain evidence, including a handshake transfer from the selling wallet.

The developer initially acquired TROLL as part of an experiment to gauge influencer interest. "No KOL except one bought it," Fawcette told Decrypt, explaining his decision to liquidate the position for a modest 9 SOL profit. The episode underscores the volatile nature of meme coins and the fortunes won and lost in their wake.

Solana Price Eyes 52% Rally to $257, Only If Institutions Stick Around

Public companies like DeFi Growth and Upexi are quietly accumulating millions in SOL, signaling long-term confidence in Solana's price trajectory. DeFi Growth alone added over 110,000 SOL last week, now holding 1.29 million tokens—a clear institutional bet.

Despite this accumulation, traders remain cautious. Short positions exceed $1.64 billion, reflecting bearish sentiment even as SOL holds steady near $168. The token's stability contrasts with broader market gains, suggesting potential energy for a breakout.

A 52% rally toward $257 remains possible if institutional demand persists and short positions unwind. Solana's path mirrors Ethereum's institutional adoption story, with public companies leading the charge rather than retail traders.

Solana Meme Coin Ponke Launches Plush Toy as First in Series of Collectibles

Ponke, a Solana-based meme coin with a substantial social media following, is launching a limited-edition plush toy of its monkey mascot priced at $69. The product features an NFC chip for ownership verification and rewards, along with interactive elements like a removable helmet and magnetic accessories.

The release marks Ponke's partnership with 223, a subsidiary of licensed accessories leader JCorp. Two additional collaborations with major brands are slated for release before year-end. Sales commence Wednesday at 1pm ET, with early access for Club Ponke members and Telegram sticker pack owners.

ONyc Launches on Kamino, Bringing Reinsurance-Backed Yield to Solana DeFi

OnRe's yield-bearing asset ONyc is now live as collateral on Kamino, Solana's largest DeFi money market with over $700M in stablecoin TVL. This marks the first integration of reinsurance-backed real-world yield into Solana's ecosystem.

The move enables users to leverage uncorrelated ~14%+ base yield through borrowing, lending, and looping strategies. Kamino's integration provides 24/7 liquidity and verifiable NAV tracking, creating new capital deployment opportunities across market conditions.

Incentive programs from USDG and Ethena aim to reduce borrowing costs while expanding yield opportunities. The development represents a significant step in bridging traditional finance yield sources with decentralized applications.

Solana Price Steadies Near $167: Is It The Perfect Buying Opportunity?

Solana's price has rebounded nearly 8% in early August after a sharp 25% decline from July highs. The recovery is supported by bullish technical indicators, rising active addresses, and positive funding rate data.

A key driver of sentiment was Solana's Seekers Mobile initiative announcement, which shifted market outlooks from bearish to bullish. Derivatives data confirms this shift, with the OI-Weighted Funding Rate flipping positive.

At press time, SOL trades around $167, showing resilience despite macroeconomic concerns. The bounce off a crucial trendline support on the daily chart suggests renewed investor confidence in the asset.

Upexi Inc. Expands Solana Holdings to Over 2M SOL, Leveraging Discounted Purchases and Staking Yields

Upexi Inc. (UPXI), a diversified brand owner based in Tampa, Florida, has more than doubled its Solana (SOL) holdings in July, surpassing 2 million tokens. The company funded the purchases through capital raised via the sale of common stock and convertible notes, totaling $200 million. CEO Allan Marshall described July as a "game-changing" month, highlighting strategic acquisitions of locked SOL at a mid-teens discount to market rates.

The firm's SOL treasury now stands at 2,000,518 tokens, generating an 8% staking yield alongside unrealized gains from discounted purchases. Upexi's shares rose 56% last month and gained 9.1% on Monday, reflecting investor confidence in its crypto strategy. The holdings trade at a basic market net asset value (mNAV) of 0.9x and a fully loaded mNAV of 1.6x, signaling potential upside as locked tokens vest.

Notable transactions included bulk purchases of 100,000 SOL on July 21 and 83,000 SOL on July 23. The company's brands span pet products (LuckyTail), supplements (Prax), and functional mushrooms (Cure Mushrooms), creating a diversified revenue stream to support its crypto treasury growth.

How High Will SOL Price Go?

Based on technicals and news catalysts, SOL could rally 52% to $257 if it breaks the 20-day MA resistance at $178. Key levels:

| Scenario | Price Target | Condition |

|---|---|---|

| Bullish | $257 | Daily close above $202 (Upper Bollinger) |

| Base Case | $200 | MACD sustains above zero line |

| Bearish | $154 | Lower Bollinger band fails as support |

William highlights: 'Whale accumulation and the Surge oracle upgrade could accelerate momentum, but traders should watch the $178 pivot.'

1